SPOILER ALERT!

Retirement Community Living - Debunking Common Myths And Misconceptions

Writer-Skaaning Raynor

If you're in your later years and prepared to write the next great phase of life, a retirement home can make it possible. Learn about a few of one of the most usual myths bordering retirement home living.

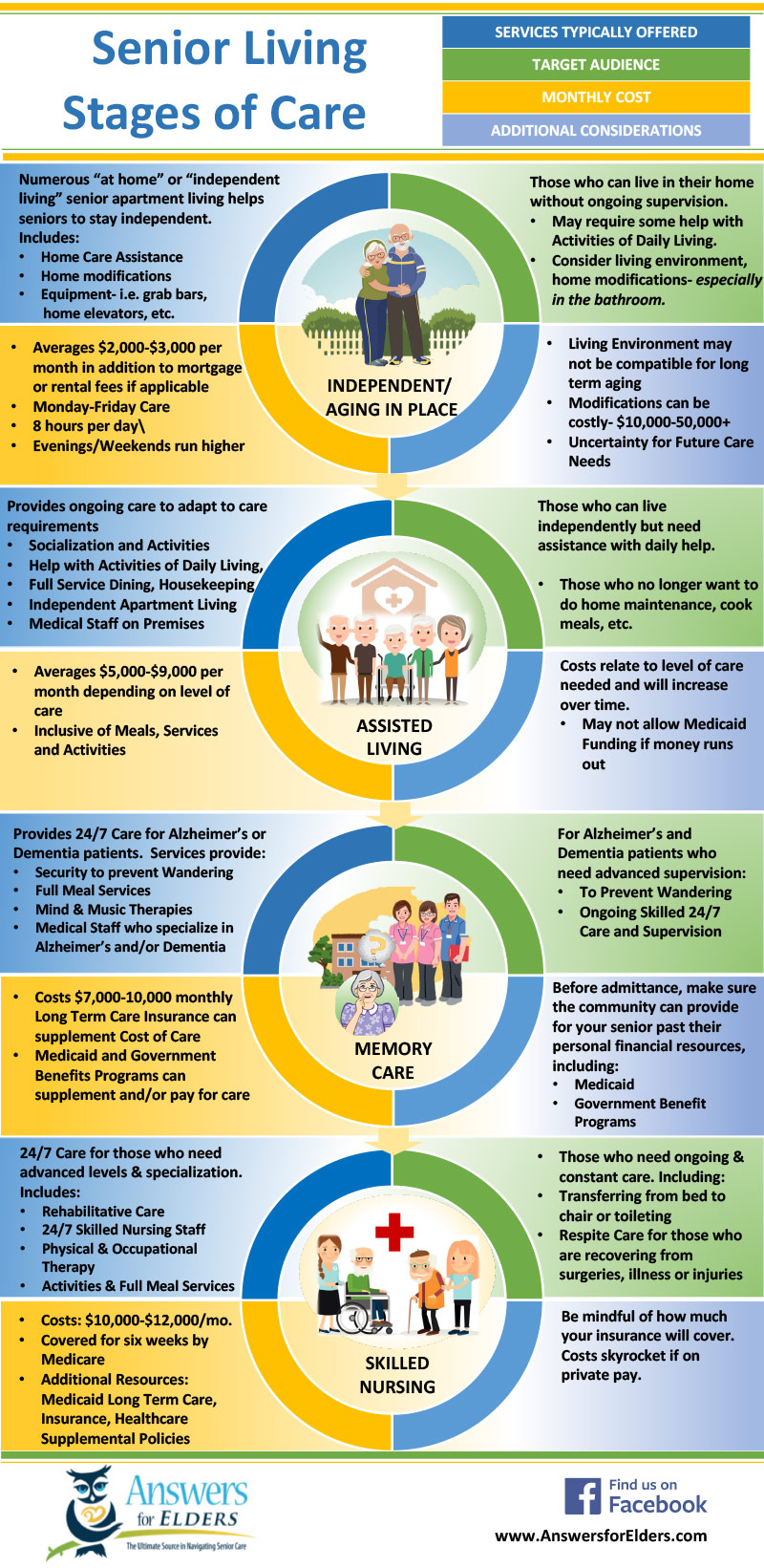

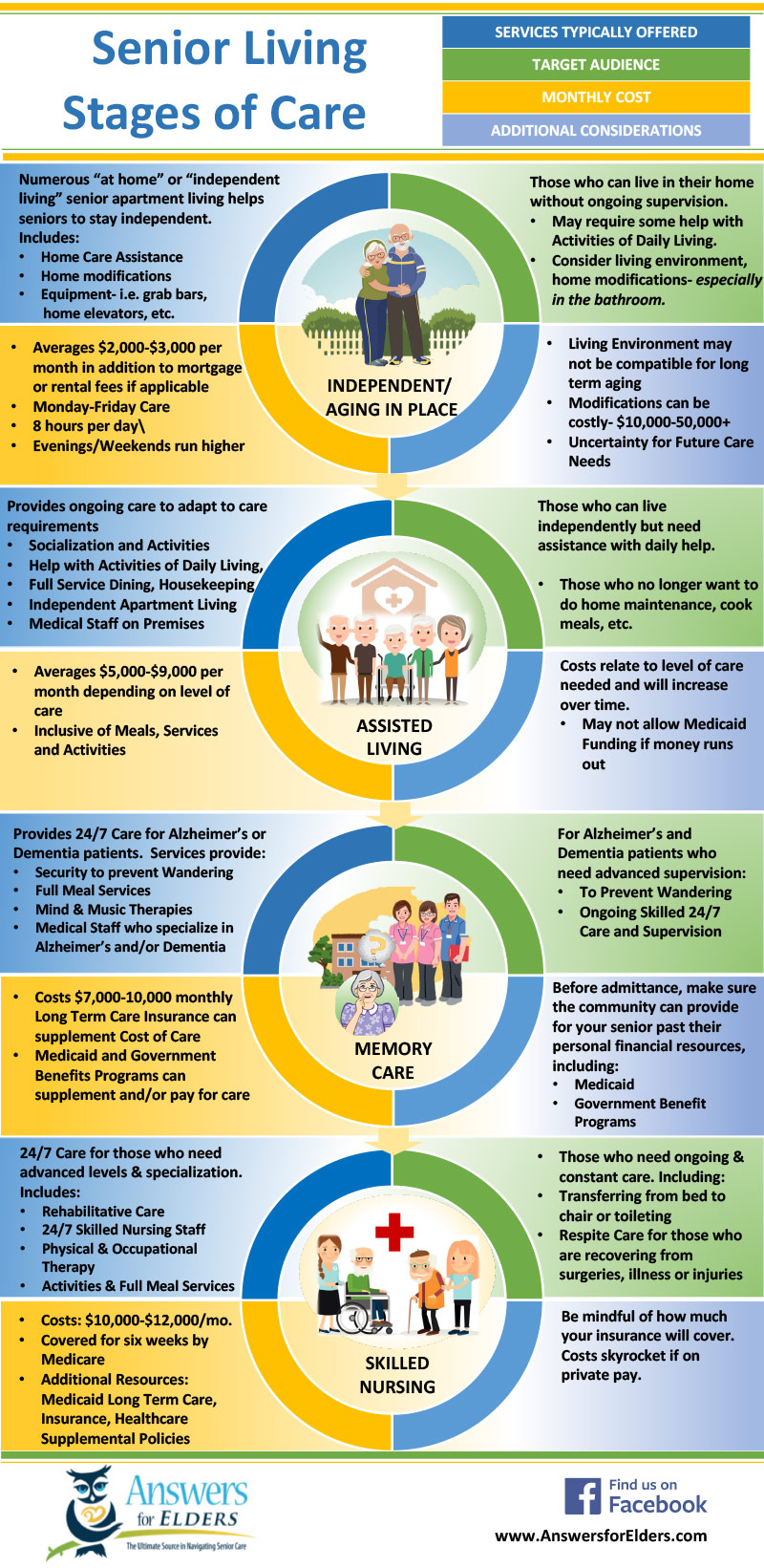

Continuing care retirement home (CCRC) provide several various degrees of treatment, so if your health and wellness deviates for the worse, you can remain in your area and get the treatment you require.

As you research your choices, inquire about entrance charges. Frequently, retirement home bill a single charge when you move in. This enables you to spending plan the cost into your plan for your future.

Likewise, check out just how you'll access care. Some areas, like Sierra Winds, provide a Life Treatment agreement that suggests you'll obtain higher levels of care in-house as your demands transform.

Lastly, think about if you 'd enjoy living near individuals you wish to hang around with. Nevertheless, socializing is one more benefit of senior living. Bid farewell to mowing, shoveling and other jobs that take up your downtime and energy at home. Rather, you'll be able to take a walk with neighbors or attend that coffeehouse or art course. You can also enjoy a group meal with each other!

Credible retirement communities have spacious apartment or condos with all the conveniences you require for a comfy life. There are additionally everyday support personnel that can examine you when you're sick (or send you soup and a hot dish if that's what you need), alter a lightbulb or aid with chores-- whatever you need.

And while you might not need a great deal of physical support, having somebody to help with those jobs that have actually been progressively becoming more difficult and more time consuming can alleviate the discomfort of a nagging back injury or an aging body. And also, an active schedule of occasions and activities will certainly keep you occupied and make it easy to meet other individuals with whom to socialize. You'll discover a new circle of good friends.

A retirement home is a special living experience for senior citizens. Along with supplying massachusetts long term care of services and services, homeowners typically take pleasure in long-lasting understanding possibilities and social tasks.

These neighborhoods have different options that are based upon what you need, such as independent living, aided living and memory treatment. These communities likewise charge an entry charge to make sure that they have the sources to give top-tier facilities and-- in some instances-- healthcare services.

Those costs are normally tax deductible as a prepaid medical cost. In the event that you require more than a retirement community can offer, the majority of have a benevolence provision in their agreements to make certain you do not need to transfer to one more location. Nonetheless, if you determine to leave, your entrance charge will not be reimbursed.

If you're thinking about retirement home living, it is necessary to recognize what it is and isn't. While http://marcus7182brenton.xtgem.com/__xt_blog/__xtblog_entry/__xtblog_entry/36004421-the-ultimate-overview-to-picking-the-right-retirement-home-for-your-lifestyle?__xtblog_block_id=1#xt_blog offer numerous services and services, they are not nursing homes.

Rather, they supply a risk-free and inviting atmosphere for seniors to enjoy their lives to the greatest. They remove the requirement to keep a big home, which can be difficult, and they likewise get rid of the demand to mow the grass, rake fallen leaves or shovel snow.

On top of that, residents rate to host family and friends participants in their personal houses any time. And if the day comes when you can no longer drive, most retirement home provide onsite transportation to location shops, sights and doctors' visits. That means you can get around easily without bothering with traffic and that one vehicle driver who is constantly in a hurry.

In some retirement communities, neighbors live very closely with each other and there is less personal privacy. Likewise, they might be more costly than other housing choices and generally do not use medical care solutions.

Retirement home residents can delight in a selection of everyday activities. They can delight in a cup of coffee in their own house, meet close friends for a marine fitness course, and join their book club after supper.

A CCRC uses an all-inclusive package of treatment. This includes independent living houses or homes, assisted living, taking care of home care, and memory care. Whether you want support now or just observant that you might eventually need treatment in the future, the peace of mind offered by a CCRC is priceless. It can aid you feel confident that your wellness demands are taken care of for the remainder of your life.

If you're in your later years and prepared to write the next great phase of life, a retirement home can make it possible. Learn about a few of one of the most usual myths bordering retirement home living.

Continuing care retirement home (CCRC) provide several various degrees of treatment, so if your health and wellness deviates for the worse, you can remain in your area and get the treatment you require.

1. You'll Have to Relocate

As you research your choices, inquire about entrance charges. Frequently, retirement home bill a single charge when you move in. This enables you to spending plan the cost into your plan for your future.

Likewise, check out just how you'll access care. Some areas, like Sierra Winds, provide a Life Treatment agreement that suggests you'll obtain higher levels of care in-house as your demands transform.

Lastly, think about if you 'd enjoy living near individuals you wish to hang around with. Nevertheless, socializing is one more benefit of senior living. Bid farewell to mowing, shoveling and other jobs that take up your downtime and energy at home. Rather, you'll be able to take a walk with neighbors or attend that coffeehouse or art course. You can also enjoy a group meal with each other!

2. You'll Be Alone

Credible retirement communities have spacious apartment or condos with all the conveniences you require for a comfy life. There are additionally everyday support personnel that can examine you when you're sick (or send you soup and a hot dish if that's what you need), alter a lightbulb or aid with chores-- whatever you need.

And while you might not need a great deal of physical support, having somebody to help with those jobs that have actually been progressively becoming more difficult and more time consuming can alleviate the discomfort of a nagging back injury or an aging body. And also, an active schedule of occasions and activities will certainly keep you occupied and make it easy to meet other individuals with whom to socialize. You'll discover a new circle of good friends.

3. You'll Have to Pay a Month-to-month Fee

A retirement home is a special living experience for senior citizens. Along with supplying massachusetts long term care of services and services, homeowners typically take pleasure in long-lasting understanding possibilities and social tasks.

These neighborhoods have different options that are based upon what you need, such as independent living, aided living and memory treatment. These communities likewise charge an entry charge to make sure that they have the sources to give top-tier facilities and-- in some instances-- healthcare services.

Those costs are normally tax deductible as a prepaid medical cost. In the event that you require more than a retirement community can offer, the majority of have a benevolence provision in their agreements to make certain you do not need to transfer to one more location. Nonetheless, if you determine to leave, your entrance charge will not be reimbursed.

4. You'll Need to Care for Your Home

If you're thinking about retirement home living, it is necessary to recognize what it is and isn't. While http://marcus7182brenton.xtgem.com/__xt_blog/__xtblog_entry/__xtblog_entry/36004421-the-ultimate-overview-to-picking-the-right-retirement-home-for-your-lifestyle?__xtblog_block_id=1#xt_blog offer numerous services and services, they are not nursing homes.

Rather, they supply a risk-free and inviting atmosphere for seniors to enjoy their lives to the greatest. They remove the requirement to keep a big home, which can be difficult, and they likewise get rid of the demand to mow the grass, rake fallen leaves or shovel snow.

On top of that, residents rate to host family and friends participants in their personal houses any time. And if the day comes when you can no longer drive, most retirement home provide onsite transportation to location shops, sights and doctors' visits. That means you can get around easily without bothering with traffic and that one vehicle driver who is constantly in a hurry.

5. You'll Have to Spend for Care

In some retirement communities, neighbors live very closely with each other and there is less personal privacy. Likewise, they might be more costly than other housing choices and generally do not use medical care solutions.

Retirement home residents can delight in a selection of everyday activities. They can delight in a cup of coffee in their own house, meet close friends for a marine fitness course, and join their book club after supper.

A CCRC uses an all-inclusive package of treatment. This includes independent living houses or homes, assisted living, taking care of home care, and memory care. Whether you want support now or just observant that you might eventually need treatment in the future, the peace of mind offered by a CCRC is priceless. It can aid you feel confident that your wellness demands are taken care of for the remainder of your life.

SPOILER ALERT!

Retirement Community Living - Debunking Common Myths And Misconceptions

Content By-Skaaning TRUE

If you're in your later years and prepared to write the following wonderful chapter of life, a retirement home can make it feasible. Learn local nursing homes about a few of one of the most common misconceptions surrounding retirement community living.

Proceeding care retirement home (CCRC) offer a number of different levels of care, so if your wellness deviates for the worse, you can remain in your neighborhood and obtain the care you need.

As you research your options, inquire about entry costs. Commonly, retirement home bill a single charge when you move in. This permits you to spending plan the cost into your plan for your future.

Also, look at how you'll access care. Some communities, like Sierra Winds, provide a Life Treatment agreement that implies you'll obtain higher degrees of treatment in-house as your requirements change.

Lastly, take into consideration if you 'd be happy living near people you want to hang out with. Besides, socialization is an additional benefit of elderly living. Bid farewell to mowing, shoveling and various other tasks that occupy your leisure time and energy at home. Instead, you'll be able to stroll with neighbors or go to that coffee shop or art course. You can even delight in a group meal together!

Credible retirement communities have large apartment or condos with all the eases you need for a comfortable life. There are also day-to-day assistance staff that can check on you when you're sick (or send you soup and a warm meal if that's what you need), change a lightbulb or help with jobs-- whatever you require.

And while you might not need a lot of physical help, having somebody to assist with those tasks that have actually been gradually becoming more difficult and more time consuming can alleviate the pain of a nagging back injury or an aging body. And also, a hectic calendar of events and tasks will certainly maintain you inhabited and make it simple to fulfill other people with whom to mingle. You'll locate a brand-new circle of buddies.

A retirement home is an one-of-a-kind living experience for elders. In addition to supplying a selection of services and services, locals usually enjoy long-lasting knowing possibilities and social tasks.

These neighborhoods have different alternatives that are based on what you need, such as independent living, aided living and memory treatment. These areas likewise charge an entry cost to guarantee that they have the sources to provide top-tier services and-- in some instances-- healthcare services.

Those costs are typically tax obligation deductible as a prepaid clinical expense. On the occasion that you require more than a retirement home can use, most have an altruism clause in their contracts to make certain you do not need to transfer to another area. However, if you determine to move out, your entrance charge will not be refunded.

If you're considering retirement community living, it is essential to comprehend what it is and isn't. While retirement home use many features and services, they are not nursing homes.

Instead, they offer a safe and welcoming atmosphere for elders to appreciate their lives to the max. They get rid of the requirement to maintain a large home, which can be demanding, and they additionally get rid of the requirement to trim the yard, rake leaves or shovel snow.

On top of that, locals are welcome to host family and friends participants in their personal houses any time. And if the day comes when you can no longer drive, the majority of retirement home provide onsite transport to location stores, sights and doctors' visits. That implies you can navigate pleasantly without stressing over web traffic and that one chauffeur that is always quickly.

In some retirement home, neighbors live carefully together and there is less personal privacy. Additionally, they may be a lot more pricey than various other real estate alternatives and generally do not supply healthcare solutions.

https://blogfreely.net/gladis5cruz/the-ultimate-guide-to-choosing-the-right-retirement-home-for-your-way-of-living can enjoy a range of daily activities. They can delight in a mug of coffee in their own home, meet buddies for an aquatic physical fitness class, and join their publication club after supper.

A CCRC uses an all-inclusive bundle of treatment. This consists of independent living houses or homes, aided living, nursing home treatment, and memory treatment. Whether you require aid now or simply cognizant that you may eventually call for care in the future, the assurance provided by a CCRC is valuable. It can help you feel great that your wellness requirements are cared for for the remainder of your life.

If you're in your later years and prepared to write the following wonderful chapter of life, a retirement home can make it feasible. Learn local nursing homes about a few of one of the most common misconceptions surrounding retirement community living.

Proceeding care retirement home (CCRC) offer a number of different levels of care, so if your wellness deviates for the worse, you can remain in your neighborhood and obtain the care you need.

1. You'll Need to Move In

As you research your options, inquire about entry costs. Commonly, retirement home bill a single charge when you move in. This permits you to spending plan the cost into your plan for your future.

Also, look at how you'll access care. Some communities, like Sierra Winds, provide a Life Treatment agreement that implies you'll obtain higher degrees of treatment in-house as your requirements change.

Lastly, take into consideration if you 'd be happy living near people you want to hang out with. Besides, socialization is an additional benefit of elderly living. Bid farewell to mowing, shoveling and various other tasks that occupy your leisure time and energy at home. Instead, you'll be able to stroll with neighbors or go to that coffee shop or art course. You can even delight in a group meal together!

2. You'll Be Alone

Credible retirement communities have large apartment or condos with all the eases you need for a comfortable life. There are also day-to-day assistance staff that can check on you when you're sick (or send you soup and a warm meal if that's what you need), change a lightbulb or help with jobs-- whatever you require.

And while you might not need a lot of physical help, having somebody to assist with those tasks that have actually been gradually becoming more difficult and more time consuming can alleviate the pain of a nagging back injury or an aging body. And also, a hectic calendar of events and tasks will certainly maintain you inhabited and make it simple to fulfill other people with whom to mingle. You'll locate a brand-new circle of buddies.

3. You'll Need to Pay a Month-to-month Charge

A retirement home is an one-of-a-kind living experience for elders. In addition to supplying a selection of services and services, locals usually enjoy long-lasting knowing possibilities and social tasks.

These neighborhoods have different alternatives that are based on what you need, such as independent living, aided living and memory treatment. These areas likewise charge an entry cost to guarantee that they have the sources to provide top-tier services and-- in some instances-- healthcare services.

Those costs are typically tax obligation deductible as a prepaid clinical expense. On the occasion that you require more than a retirement home can use, most have an altruism clause in their contracts to make certain you do not need to transfer to another area. However, if you determine to move out, your entrance charge will not be refunded.

4. You'll Have to Look after Your Home

If you're considering retirement community living, it is essential to comprehend what it is and isn't. While retirement home use many features and services, they are not nursing homes.

Instead, they offer a safe and welcoming atmosphere for elders to appreciate their lives to the max. They get rid of the requirement to maintain a large home, which can be demanding, and they additionally get rid of the requirement to trim the yard, rake leaves or shovel snow.

On top of that, locals are welcome to host family and friends participants in their personal houses any time. And if the day comes when you can no longer drive, the majority of retirement home provide onsite transport to location stores, sights and doctors' visits. That implies you can navigate pleasantly without stressing over web traffic and that one chauffeur that is always quickly.

5. You'll Have to Spend for Care

In some retirement home, neighbors live carefully together and there is less personal privacy. Additionally, they may be a lot more pricey than various other real estate alternatives and generally do not supply healthcare solutions.

https://blogfreely.net/gladis5cruz/the-ultimate-guide-to-choosing-the-right-retirement-home-for-your-way-of-living can enjoy a range of daily activities. They can delight in a mug of coffee in their own home, meet buddies for an aquatic physical fitness class, and join their publication club after supper.

A CCRC uses an all-inclusive bundle of treatment. This consists of independent living houses or homes, aided living, nursing home treatment, and memory treatment. Whether you require aid now or simply cognizant that you may eventually call for care in the future, the assurance provided by a CCRC is valuable. It can help you feel great that your wellness requirements are cared for for the remainder of your life.

SPOILER ALERT!

Planning For The Future - A Comprehensive List For Transitioning To A Retirement Community

Write- https://squareblogs.net/hollie97jacquelynn/how-to-choose-the-right-retirement-home-for-your-lifestyle -Barber Kronborg

As people with intellectual and developmental impairments age, families need to plan for the future. This can help them live a good life as independently as feasible.

The planning process includes establishing objectives, doing something about it, and celebrating turning points in the process. https://dispatchnews.com/Content/Default/Generation-50/Article/Savvy-Senior-Tips-and-tools-for-family-caregivers-/-3/564/12287 is made to help individuals and their relative get started on this trip.

Whether you're planning for retired life or simply starting to consider it, it is very important to identify your requirements when selecting the appropriate location for you. Do you require a close-knit area, very easy access to healthcare or more social tasks? What are your budget plan and transport requirements?

When https://squareblogs.net/tammera2antonio/exactly-how-to-choose-the-right-retirement-home-for-your-way-of-life 've established your demands, it's time to discover a retirement home that can genuinely meet them. It's additionally a great idea to explore the residential or commercial property and ask if you can stay for lunch or an activity to see what life is really like there.

For example, several elderly living areas will certainly consist of yard job and snow removal as part of your month-to-month fees, removing the requirement to schedule a garden enthusiast or spend hours shoveling your driveway. They might likewise supply in-house health care solutions such as physical therapy or massage, which can prove advantageous in the future. Choosing a community that uses a continuum of treatment will likewise guarantee that you do not have to relocate once more in the event your demands transform.

Transferring to a retirement community is an exciting phase in life that can additionally feel complicated. By being aggressive and putting together a roadmap for the change, older grownups can see to it they're prepared for a smooth beginning.

Strategy to go to the area before your loved one relocate to obtain familiar with their brand-new home. Take an excursion, satisfy staff and residents, and sample the food (when possible).

Ensure your enjoyed ones have their utilities cancelled at their old home and are set up with those at their new area. It's likewise a good idea to cancel any kind of membership services, shopping internet sites or other on the internet accounts that have their old address on documents.

Urge your enjoyed ones to take part in neighborhood occasions prior to they move-in so they can fulfill other locals and begin to obtain adapted. This will help them to feel even more at home and will be a wonderful way to begin their new life off on the appropriate foot.

Relying on your wellness and movement needs, you may have various demands for the kind of retirement community that will certainly best suit you. As an example, if you need to have a single-story home to stay clear of stairways, it is very important to pick a community that can use this. You need to also consider your social and entertainment rate of interests. If going to friends and family is very important to you, see to it that the community you choose enables you to see them often.

At the same time, it is essential to be adaptable when choosing a retirement home. The concrete style of steps to flexibilize retirement changes is definitive for the extent to which they are really able to aid people achieve their desired retired life results. This is because, as an example, access to plans like subsidized wage top-ups is normally dependent on the fulfilment of details problems such as contribution periods (see Latulippe and Turner 2000: 183). The exact same applies to other kinds of specific strategies to flexibilize the retired life shift, such as decreasing job hours.

A substantial modification like relocating to a retirement home can trigger a host of feelings for elderly grownups. It's important to pay attention to their concerns and allow them to reveal their feelings without objection or judgment. After that, provide an electrical outlet so they can proceed to a positive state of mind.

Urge your loved one to fraternize their new next-door neighbors. The people they fulfill may have undergone a similar situation and can be a resource of assistance throughout this shift period. Ask the area if they supply resident welcome occasions or a support system. If they don't, you can take into consideration asking a therapist to make normal sees to the retirement home to assist with managing RSS.

Taking the right steps can help your parents find success in their new home. By preparing ahead, entailing enjoyed ones, prioritizing familiarity, staying active, developing regimens, looking for expert support, and providing it time, your loved one will certainly be able to enjoy their new way of living to the max.

As people with intellectual and developmental impairments age, families need to plan for the future. This can help them live a good life as independently as feasible.

The planning process includes establishing objectives, doing something about it, and celebrating turning points in the process. https://dispatchnews.com/Content/Default/Generation-50/Article/Savvy-Senior-Tips-and-tools-for-family-caregivers-/-3/564/12287 is made to help individuals and their relative get started on this trip.

1. Recognize Your Demands

Whether you're planning for retired life or simply starting to consider it, it is very important to identify your requirements when selecting the appropriate location for you. Do you require a close-knit area, very easy access to healthcare or more social tasks? What are your budget plan and transport requirements?

When https://squareblogs.net/tammera2antonio/exactly-how-to-choose-the-right-retirement-home-for-your-way-of-life 've established your demands, it's time to discover a retirement home that can genuinely meet them. It's additionally a great idea to explore the residential or commercial property and ask if you can stay for lunch or an activity to see what life is really like there.

For example, several elderly living areas will certainly consist of yard job and snow removal as part of your month-to-month fees, removing the requirement to schedule a garden enthusiast or spend hours shoveling your driveway. They might likewise supply in-house health care solutions such as physical therapy or massage, which can prove advantageous in the future. Choosing a community that uses a continuum of treatment will likewise guarantee that you do not have to relocate once more in the event your demands transform.

2. Create a Roadmap

Transferring to a retirement community is an exciting phase in life that can additionally feel complicated. By being aggressive and putting together a roadmap for the change, older grownups can see to it they're prepared for a smooth beginning.

Strategy to go to the area before your loved one relocate to obtain familiar with their brand-new home. Take an excursion, satisfy staff and residents, and sample the food (when possible).

Ensure your enjoyed ones have their utilities cancelled at their old home and are set up with those at their new area. It's likewise a good idea to cancel any kind of membership services, shopping internet sites or other on the internet accounts that have their old address on documents.

Urge your enjoyed ones to take part in neighborhood occasions prior to they move-in so they can fulfill other locals and begin to obtain adapted. This will help them to feel even more at home and will be a wonderful way to begin their new life off on the appropriate foot.

3. Be Flexible

Relying on your wellness and movement needs, you may have various demands for the kind of retirement community that will certainly best suit you. As an example, if you need to have a single-story home to stay clear of stairways, it is very important to pick a community that can use this. You need to also consider your social and entertainment rate of interests. If going to friends and family is very important to you, see to it that the community you choose enables you to see them often.

At the same time, it is essential to be adaptable when choosing a retirement home. The concrete style of steps to flexibilize retirement changes is definitive for the extent to which they are really able to aid people achieve their desired retired life results. This is because, as an example, access to plans like subsidized wage top-ups is normally dependent on the fulfilment of details problems such as contribution periods (see Latulippe and Turner 2000: 183). The exact same applies to other kinds of specific strategies to flexibilize the retired life shift, such as decreasing job hours.

4. Seek Assistance

A substantial modification like relocating to a retirement home can trigger a host of feelings for elderly grownups. It's important to pay attention to their concerns and allow them to reveal their feelings without objection or judgment. After that, provide an electrical outlet so they can proceed to a positive state of mind.

Urge your loved one to fraternize their new next-door neighbors. The people they fulfill may have undergone a similar situation and can be a resource of assistance throughout this shift period. Ask the area if they supply resident welcome occasions or a support system. If they don't, you can take into consideration asking a therapist to make normal sees to the retirement home to assist with managing RSS.

Taking the right steps can help your parents find success in their new home. By preparing ahead, entailing enjoyed ones, prioritizing familiarity, staying active, developing regimens, looking for expert support, and providing it time, your loved one will certainly be able to enjoy their new way of living to the max.

SPOILER ALERT!

Healthy Aging: The Function Of Health Programs In Retired Life Communities

Write-Up Produced By-Rafn Bengtsen

Today's retirement communities are changing the means they look at elderly health. They're welcoming much more extensive health and wellness and well-being programs that sustain an active lifestyle.

Structured day-to-day regimens are a key element of these programs. As elders feel much healthier, their determination to participate in community tasks rises. A variety of workout courses are likewise motivated to assist homeowners stay up to date with health and fitness objectives.

CCRC and senior living neighborhoods provide wellness programs that deal with the requirements of every age and phase. They have their eye on current technology and upcoming innovations in research that can enhance the quality of life and durability for senior citizens.

Health and wellness and wellness programs have a significant influence on residents' satisfaction with their neighborhood. Actually, the ICAA/ProMatura study located that wellness way of living programs are among the leading reasons elders choose their areas.

Whether it's an on-site fitness center providing day-to-day workout courses, yoga exercise or tai chi, or team trips to neighboring galleries and scenic routes, these programs aid elders remain healthy and active. They additionally permit them to connect with their peers, reinforcing psychological health and battling feelings of loneliness. Homeowners who participate in these activities are happier, healthier and more satisfied with their neighborhood.

Exercise boosts cognitive health and wellness, reduces the danger of illness and supports balance and toughness. please click the following web site reduces stress and gives a means for elders to interact socially, which fights isolation.

As opposed to limiting fitness to the drab workout area, retirement communities supply a range of enjoyable, energetic choices that make working up a sweat really pleasurable. These programs avoid locals from adopting sedentary way of lives and keep them engaged, which causes them meeting two years much longer than non-participants.

Likewise, senior wellness shows offers chances to engage frequently with other community participants. https://writeablog.net/franklyn3amado/the-advantages-of-socializing-in-a-retirement-community-a-comprehensive like art, cooking or a publication club or offering for a neighborhood cause can help senior citizens build connections to their community and feel a sense of belonging. These tasks additionally permit them to share specialized expertise and abilities with others, which has actually been shown to soothe stress.

Healthy aging entails keeping your physical health via workout, eating healthy food and taking medicines as guided. It also consists of social health, psychological health and cognitive performance.

Neighborhoods that concentrate on whole-person wellness have actually located that their homeowners are a lot more satisfied with their way of lives. For example, a current research from ICAA and ProMatura Team showed that CCRCs with active health cares have greater levels of client complete satisfaction than those without them.

In addition to using physical fitness courses and cutting edge health clubs, these programs have actually likewise integrated brand-new patterns like reflection and mindfulness. Research study reveals that these practices can reduce tension and improve rest, which are both essential for total wellness. Lots of senior living neighborhoods currently supply these methods and give support on how to incorporate them into day-to-day regimens.

Socializing is an essential element of psychological wellness and aids people manage extreme life changes and experiences. click for more info who have helpful networks often tend to be healthier, experience much less anxiety and have higher resiliency.

Offering lots of opportunities for senior citizens to participate in social activities is a great way to promote healthy aging. Lots of CCRCs feature intergenerational programs where seniors share their abilities and experience with young people, while younger residents get self-reliance and feel valued in the area.

Neighborhoods that use a varied variety of exercise and wellness courses find improved community engagement, which causes far better wellness for their locals. They likewise see a boost in referrals, which eventually adds to the success of their wellness programs. Investing in this type of programs returns both instant and lasting benefits for the citizens of an elderly living neighborhood.

The physical and social aspects of wellness are very important, but psychological wellness also plays a role. Senior living communities that use on-site counseling, peaceful locations for reflection, and chances to explore one's spirituality can assist homeowners remain healthy in mind and spirit.

When seniors really feel good, they usually find themselves much more satisfied with their general area. This is why many retirement home implement comprehensive wellness lifestyle programs.

For example, effective programs make workout not just desirable however expected. A well-trained personnel and structured regimens that urge energetic daily living can assist stop elders from taking on inactive habits and enhance their readiness to take part in other activities. This, subsequently, can help boost business outcomes and attract new residents. For more details on finding a CCRC that has these types of durable wellness programs, call us.

Today's retirement communities are changing the means they look at elderly health. They're welcoming much more extensive health and wellness and well-being programs that sustain an active lifestyle.

Structured day-to-day regimens are a key element of these programs. As elders feel much healthier, their determination to participate in community tasks rises. A variety of workout courses are likewise motivated to assist homeowners stay up to date with health and fitness objectives.

Wellness Screenings

CCRC and senior living neighborhoods provide wellness programs that deal with the requirements of every age and phase. They have their eye on current technology and upcoming innovations in research that can enhance the quality of life and durability for senior citizens.

Health and wellness and wellness programs have a significant influence on residents' satisfaction with their neighborhood. Actually, the ICAA/ProMatura study located that wellness way of living programs are among the leading reasons elders choose their areas.

Whether it's an on-site fitness center providing day-to-day workout courses, yoga exercise or tai chi, or team trips to neighboring galleries and scenic routes, these programs aid elders remain healthy and active. They additionally permit them to connect with their peers, reinforcing psychological health and battling feelings of loneliness. Homeowners who participate in these activities are happier, healthier and more satisfied with their neighborhood.

Exercise

Exercise boosts cognitive health and wellness, reduces the danger of illness and supports balance and toughness. please click the following web site reduces stress and gives a means for elders to interact socially, which fights isolation.

As opposed to limiting fitness to the drab workout area, retirement communities supply a range of enjoyable, energetic choices that make working up a sweat really pleasurable. These programs avoid locals from adopting sedentary way of lives and keep them engaged, which causes them meeting two years much longer than non-participants.

Likewise, senior wellness shows offers chances to engage frequently with other community participants. https://writeablog.net/franklyn3amado/the-advantages-of-socializing-in-a-retirement-community-a-comprehensive like art, cooking or a publication club or offering for a neighborhood cause can help senior citizens build connections to their community and feel a sense of belonging. These tasks additionally permit them to share specialized expertise and abilities with others, which has actually been shown to soothe stress.

Nourishment

Healthy aging entails keeping your physical health via workout, eating healthy food and taking medicines as guided. It also consists of social health, psychological health and cognitive performance.

Neighborhoods that concentrate on whole-person wellness have actually located that their homeowners are a lot more satisfied with their way of lives. For example, a current research from ICAA and ProMatura Team showed that CCRCs with active health cares have greater levels of client complete satisfaction than those without them.

In addition to using physical fitness courses and cutting edge health clubs, these programs have actually likewise integrated brand-new patterns like reflection and mindfulness. Research study reveals that these practices can reduce tension and improve rest, which are both essential for total wellness. Lots of senior living neighborhoods currently supply these methods and give support on how to incorporate them into day-to-day regimens.

Socialization

Socializing is an essential element of psychological wellness and aids people manage extreme life changes and experiences. click for more info who have helpful networks often tend to be healthier, experience much less anxiety and have higher resiliency.

Offering lots of opportunities for senior citizens to participate in social activities is a great way to promote healthy aging. Lots of CCRCs feature intergenerational programs where seniors share their abilities and experience with young people, while younger residents get self-reliance and feel valued in the area.

Neighborhoods that use a varied variety of exercise and wellness courses find improved community engagement, which causes far better wellness for their locals. They likewise see a boost in referrals, which eventually adds to the success of their wellness programs. Investing in this type of programs returns both instant and lasting benefits for the citizens of an elderly living neighborhood.

Mental Health and wellness

The physical and social aspects of wellness are very important, but psychological wellness also plays a role. Senior living communities that use on-site counseling, peaceful locations for reflection, and chances to explore one's spirituality can assist homeowners remain healthy in mind and spirit.

When seniors really feel good, they usually find themselves much more satisfied with their general area. This is why many retirement home implement comprehensive wellness lifestyle programs.

For example, effective programs make workout not just desirable however expected. A well-trained personnel and structured regimens that urge energetic daily living can assist stop elders from taking on inactive habits and enhance their readiness to take part in other activities. This, subsequently, can help boost business outcomes and attract new residents. For more details on finding a CCRC that has these types of durable wellness programs, call us.

SPOILER ALERT!

Financial Planning For Retirement Home Living: What You Required To Know

Article Writer-Lamb Cochran

Spending for retirement community living needs careful financial preparation. Begin by tallying up existing expenditures and comparing them with costs of care at elderly living areas.

Long-term treatment insurance (LTCI) is a popular choice for covering retirement home prices. Testimonial your policy to understand its terms, fees and insurance coverage.

Utilizing home equity is one more usual method to fund elderly living. Nonetheless, accessing your home equity can have unpredicted consequences.

When it pertains to senior living prices, the earlier you begin monetary preparing the much better. This provides you more time to build cost savings, financial investments, and explore various alternatives. An economic consultant can help you with the essentials and facility choices, consisting of exactly how to maximize your retirement income.

Accessing home equity is a popular way to spend for elderly living, however it is necessary to consider the benefits and drawbacks prior to deciding. For instance, offering your house may be easier than renting out or getting a reverse home loan, yet it can also affect your family members's financial resources in the short-term and lower the amount of living area you have.

Most Independent Living communities include housing, utilities, meals, housekeeping, social tasks, and transport in their prices. Nevertheless, massachusetts long term care is essential to recognize that fees usually increase in time as the community needs to cover expenditures like personnel wages, materials, and brand-new services. Seek a Life Strategy Neighborhood that provides an adaptable cost structure like Flexibility Plaza's.

Having a precise understanding of their financial resources is vital for elders planning to shift right into retirement community living. Begin by assembling a thorough listing of income sources and costs, including any kind of set regular monthly expenses like housing, energies, car repayments, insurance coverage, etc and those that fluctuate from month to month, such as groceries, enjoyment, and drugs.

When determining their spending plan, seniors need to likewise consider the distinction in cost in between a single-family home and a retirement community. This can help them establish which alternative may fit their demands and monetary circumstance finest.

When picking a neighborhood, make sure to inquire about their pricing framework and make note of any type of covert costs. The majority of communities answer these concerns on a regular basis and are transparent regarding the costs related to their treatment. If they're not, this should be a warning. Lastly, don't neglect to make up tax obligations. Both entrance and regular monthly costs at CCRCs that supply healthcare are qualified for tax obligation reductions.

One of one of the most vital facets of retirement planning is guaranteeing that you have adequate cash to cover every one of your expenditures. One way to do this is by establishing an emergency situation interest-bearing account, which should hold about six months of living costs. Another means is to set up a regular transfer between your checking account and your financial investment accounts, which will make sure that you are conserving regularly.

It's additionally a great idea to diversify your investments to ensure that you can weather market turbulence. It's advised that you hold a profile that is comprised of 70% supplies and 30% bonds. If you are concerned about balancing your dangers and returns, think about working with a monetary specialist to discover a strategy that works finest for your requirements.

Numerous seniors additionally locate it useful to purchase long-term care insurance (LTCI) to cover the price of assisted living, memory treatment, and retirement home treatment. Nonetheless, it's essential to review LTCI policies meticulously to see to it that they cover your anticipated expenses.

Lots of family members pick to employ an economic coordinator to aid with the planning procedure. These specialists can give expert guidance on the ideas mentioned over and extra, like budgeting, tax strategies, and facility choices, such as marketing a life insurance policy plan.

https://zenwriting.net/raymond44clemencia/trick-variables-to-consider-when-selecting-a-retirement-home that prepare to move into a retirement community should take into consideration all the expenses they will certainly face, consisting of real estate costs, food, solutions, and transport. This will help them to determine if they can manage the living costs.

When comparing expenses, bear in mind that not all neighborhoods bill the same charges. Some are extra pricey than others, and the cost of senior living can differ by location. Ask areas what their costs are and ensure that they address you honestly and transparently. If a neighborhood is not flexible in its rates, that ought to be a warning.

Spending for retirement community living needs careful financial preparation. Begin by tallying up existing expenditures and comparing them with costs of care at elderly living areas.

Long-term treatment insurance (LTCI) is a popular choice for covering retirement home prices. Testimonial your policy to understand its terms, fees and insurance coverage.

Utilizing home equity is one more usual method to fund elderly living. Nonetheless, accessing your home equity can have unpredicted consequences.

Begin Early

When it pertains to senior living prices, the earlier you begin monetary preparing the much better. This provides you more time to build cost savings, financial investments, and explore various alternatives. An economic consultant can help you with the essentials and facility choices, consisting of exactly how to maximize your retirement income.

Accessing home equity is a popular way to spend for elderly living, however it is necessary to consider the benefits and drawbacks prior to deciding. For instance, offering your house may be easier than renting out or getting a reverse home loan, yet it can also affect your family members's financial resources in the short-term and lower the amount of living area you have.

Most Independent Living communities include housing, utilities, meals, housekeeping, social tasks, and transport in their prices. Nevertheless, massachusetts long term care is essential to recognize that fees usually increase in time as the community needs to cover expenditures like personnel wages, materials, and brand-new services. Seek a Life Strategy Neighborhood that provides an adaptable cost structure like Flexibility Plaza's.

Create a Budget

Having a precise understanding of their financial resources is vital for elders planning to shift right into retirement community living. Begin by assembling a thorough listing of income sources and costs, including any kind of set regular monthly expenses like housing, energies, car repayments, insurance coverage, etc and those that fluctuate from month to month, such as groceries, enjoyment, and drugs.

When determining their spending plan, seniors need to likewise consider the distinction in cost in between a single-family home and a retirement community. This can help them establish which alternative may fit their demands and monetary circumstance finest.

When picking a neighborhood, make sure to inquire about their pricing framework and make note of any type of covert costs. The majority of communities answer these concerns on a regular basis and are transparent regarding the costs related to their treatment. If they're not, this should be a warning. Lastly, don't neglect to make up tax obligations. Both entrance and regular monthly costs at CCRCs that supply healthcare are qualified for tax obligation reductions.

Review Your Investments

One of one of the most vital facets of retirement planning is guaranteeing that you have adequate cash to cover every one of your expenditures. One way to do this is by establishing an emergency situation interest-bearing account, which should hold about six months of living costs. Another means is to set up a regular transfer between your checking account and your financial investment accounts, which will make sure that you are conserving regularly.

It's additionally a great idea to diversify your investments to ensure that you can weather market turbulence. It's advised that you hold a profile that is comprised of 70% supplies and 30% bonds. If you are concerned about balancing your dangers and returns, think about working with a monetary specialist to discover a strategy that works finest for your requirements.

Numerous seniors additionally locate it useful to purchase long-term care insurance (LTCI) to cover the price of assisted living, memory treatment, and retirement home treatment. Nonetheless, it's essential to review LTCI policies meticulously to see to it that they cover your anticipated expenses.

Get Assistance

Lots of family members pick to employ an economic coordinator to aid with the planning procedure. These specialists can give expert guidance on the ideas mentioned over and extra, like budgeting, tax strategies, and facility choices, such as marketing a life insurance policy plan.

https://zenwriting.net/raymond44clemencia/trick-variables-to-consider-when-selecting-a-retirement-home that prepare to move into a retirement community should take into consideration all the expenses they will certainly face, consisting of real estate costs, food, solutions, and transport. This will help them to determine if they can manage the living costs.

When comparing expenses, bear in mind that not all neighborhoods bill the same charges. Some are extra pricey than others, and the cost of senior living can differ by location. Ask areas what their costs are and ensure that they address you honestly and transparently. If a neighborhood is not flexible in its rates, that ought to be a warning.

SPOILER ALERT!

Vital Amenities To Search For In A Retirement Home

ccrc ma Written By-Cooper Hsu

Trying to find a terrific retirement community is greater than simply picking a comfy apartment. It is necessary to seek services that sustain your enjoyed one's health and happiness.

For instance, take into consideration a retirement community that offers strolling paths and gardens for secure exterior workout. Or, find out if the community has a collection with accessibility to long-lasting discovering programs and classes.

Whether you are healthy and don't require help with everyday living tasks now or recognize that a person day you will, retirement community health and fitness programs can maintain you really feeling strong and active. Workout has actually been shown to reduce numerous usual health issues, consisting of heart problem and weight problems.

Physical fitness room style should stabilize increased air flow needs with energy use and sustainability problems, and supply a selection of sights to motivate patrons. Differ interior quantity to prevent a "big box" really feel, and utilize shade options that coordinate with the clothes of the customers.

When you're ready to move out of your very own home, there are a number of housing choices readily available for older grownups. Some are single-family homes, while others are apartment building with a property owners association and attendant services. An additional alternative is a Leisure-Oriented Retirement Home (LORC). These neighborhoods offer possibilities, solutions, and facilities for seeking leisure activities. Some LORCs additionally provide supportive services. These can consist of housekeeping, washing, and transportation to neighborhood events and destinations.

A community's dining options are a major variable prospective locals take into consideration when choosing a retirement home. The dining experience ought to be adaptable, meet nutritional needs, and provide a pleasurable socializing possibility for the elderly populace.

Dining rooms that offer restaurant-style solution supply a sit-down setup where elders enjoy meals with pals and neighbors. Areas that additionally consist of a coffee bar, deli-style market, or various other alternatives permit homeowners to select from a selection of meals throughout the day, satisfying their individual tastes and nutritional choices.

Some CCRCs have actually also eschewed the traditional banquet-style tables and team clothes for relaxing community settings with smaller sized tables for closer discussion and a much more intimate eating experience. They likewise serve food that is cooked to order, which improves high quality and lowers wasted calories and sodium. They also reuse the nutrient-rich garden compost in their area gardens, advertising sustainability and giving back to the environment. Regional eats and seasonal choices are prominent menu selections that help advertise healthy consuming practices among the senior populace.

Several senior citizens look for areas with a vast option of social tasks to keep them connected. These can be anything from a publication club, which can assist enhance cognitive function to a craft course where residents collaborate with their hands. Typically, these sort of tasks can also function as exercise by using fine electric motor abilities or the mind's creativity.

In addition to these, retirement home commonly offer group outings that provide seniors a chance to obtain some exercise, examine their knowledge or fulfill brand-new individuals. These can consist of enjoyable purchasing trips, visiting neighborhood restaurants or perhaps bird-watching adventures.

While remaining literally mouse click the up coming website page is essential for senior health and wellness, being socially involved is just as essential. That's why it is essential to discover an area that understands this and uses a range of social tasks for all interests. This can aid stop sensations of solitude and seclusion that can take place in the absence of family or friends nearby.

A retirement community that offers available transport is important for many elders. Look for a specialist shuttle solution with schedules that fit hectic lives, as well as the ability to take locals to their physician's appointments and shopping journeys.

Whether it's a golf course, tennis courts or a neighborhood yard, green room is one more very popular service for senior citizens. It gives a feeling of serenity, and helps to keep senior citizens energetic by providing ways to check out and get in touch with nature.

Make sure that your liked one's apartment or condo is designed with their requirements in mind, including vast entrances and spacious shower rooms with grab bars and a step-in shower. Additionally take notice of just how much all-natural light the apartment or condo obtains, as it can be a lifesaver for seniors living with vision impairments.

Trying to find a terrific retirement community is greater than simply picking a comfy apartment. It is necessary to seek services that sustain your enjoyed one's health and happiness.

For instance, take into consideration a retirement community that offers strolling paths and gardens for secure exterior workout. Or, find out if the community has a collection with accessibility to long-lasting discovering programs and classes.

Gym

Whether you are healthy and don't require help with everyday living tasks now or recognize that a person day you will, retirement community health and fitness programs can maintain you really feeling strong and active. Workout has actually been shown to reduce numerous usual health issues, consisting of heart problem and weight problems.

Physical fitness room style should stabilize increased air flow needs with energy use and sustainability problems, and supply a selection of sights to motivate patrons. Differ interior quantity to prevent a "big box" really feel, and utilize shade options that coordinate with the clothes of the customers.

When you're ready to move out of your very own home, there are a number of housing choices readily available for older grownups. Some are single-family homes, while others are apartment building with a property owners association and attendant services. An additional alternative is a Leisure-Oriented Retirement Home (LORC). These neighborhoods offer possibilities, solutions, and facilities for seeking leisure activities. Some LORCs additionally provide supportive services. These can consist of housekeeping, washing, and transportation to neighborhood events and destinations.

On-Site Eating

A community's dining options are a major variable prospective locals take into consideration when choosing a retirement home. The dining experience ought to be adaptable, meet nutritional needs, and provide a pleasurable socializing possibility for the elderly populace.

Dining rooms that offer restaurant-style solution supply a sit-down setup where elders enjoy meals with pals and neighbors. Areas that additionally consist of a coffee bar, deli-style market, or various other alternatives permit homeowners to select from a selection of meals throughout the day, satisfying their individual tastes and nutritional choices.

Some CCRCs have actually also eschewed the traditional banquet-style tables and team clothes for relaxing community settings with smaller sized tables for closer discussion and a much more intimate eating experience. They likewise serve food that is cooked to order, which improves high quality and lowers wasted calories and sodium. They also reuse the nutrient-rich garden compost in their area gardens, advertising sustainability and giving back to the environment. Regional eats and seasonal choices are prominent menu selections that help advertise healthy consuming practices among the senior populace.

Social Activities

Several senior citizens look for areas with a vast option of social tasks to keep them connected. These can be anything from a publication club, which can assist enhance cognitive function to a craft course where residents collaborate with their hands. Typically, these sort of tasks can also function as exercise by using fine electric motor abilities or the mind's creativity.

In addition to these, retirement home commonly offer group outings that provide seniors a chance to obtain some exercise, examine their knowledge or fulfill brand-new individuals. These can consist of enjoyable purchasing trips, visiting neighborhood restaurants or perhaps bird-watching adventures.

While remaining literally mouse click the up coming website page is essential for senior health and wellness, being socially involved is just as essential. That's why it is essential to discover an area that understands this and uses a range of social tasks for all interests. This can aid stop sensations of solitude and seclusion that can take place in the absence of family or friends nearby.

Transport

A retirement community that offers available transport is important for many elders. Look for a specialist shuttle solution with schedules that fit hectic lives, as well as the ability to take locals to their physician's appointments and shopping journeys.

Whether it's a golf course, tennis courts or a neighborhood yard, green room is one more very popular service for senior citizens. It gives a feeling of serenity, and helps to keep senior citizens energetic by providing ways to check out and get in touch with nature.

Make sure that your liked one's apartment or condo is designed with their requirements in mind, including vast entrances and spacious shower rooms with grab bars and a step-in shower. Additionally take notice of just how much all-natural light the apartment or condo obtains, as it can be a lifesaver for seniors living with vision impairments.

SPOILER ALERT!

Just How To Select The Right Retirement Home For Your Way Of Living

Writer-Rosen Rodriguez

Choosing a retirement home that enables you to follow your passions is very important. If you want horticulture, cooking, music, art, or motion picture evenings, a community that does not supply these opportunities can really feel disjointed and separated.

Observe just how homeowners and employee communicate when you see an area. This can tell you a great deal concerning the setting.

The place of your retirement community will influence just how you experience life and play. You may favor to hug friends and family, yet you might also intend to transfer to a much more temperate climate or a place with a various culture.

When you check out a prospective retirement community, drive around and see just how easy it is to get from one part of the residential property to one more. You ought to additionally take note of safety and security measures and safety functions. Ask about visiting hours and whether there is a check-in area for site visitors, and make sure that the facility uses a variety of means to make medical consultations with neighborhood specialists (physiotherapists, optometrist, dental practitioners).

If you pick to purchase a home in a community, make sure to consider month-to-month homeowner organization costs, in addition to real estate taxes. These costs assist keep the grounds and typical locations, and can include pool maintenance, lawn care, utility costs, and fitness solutions.

There are several factors to consider when choosing the appropriate retirement home. Expenses are very important to take into consideration, but it is important to also evaluate the level of services provided. Services include housekeeping, restaurant-style dining, transportation solutions, and other services like visitor dishes and concierge solution. Some communities offer these services as part of the flat monthly fee, while others may charge extra costs for medical-related services or medication management.

find more -72.57557943291285!3d42.11033545084142!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x89e6e7c483c68d3b%3A0xd8a264e7012086a5!2sLoomis%20Lakeside%20at%20Reeds%20Landing%20in%20Springfield!5e0!3m2!1sen!2sus!4v1699913940460!5m2!1sen!2sus" width="600" height="450" style="border:0;" allowfullscreen="" loading="lazy" referrerpolicy="no-referrer-when-downgrade">

Make certain to tour the area and observe just how homeowners interact with one another. If possible, demand to see an updated calendar of events and note whether the tasks match your interests. For example, if you have a passion for arts and crafts, you should discover if the retirement community uses areas devoted to artistic leisure or workshops. You ought to additionally pay very close attention to whether the community motivates sees from member of the family. If not, you might require to look in other places. If so, you might intend to pick a much more independent living community that provides a variety of features and services to match your way of life requires.

Numerous retirement communities have a variety of socialization possibilities. Mealtimes are excellent areas to satisfy individuals and appreciate the business of others, with lots of offering restaurant-style dining choices for breakfast, lunch, dinner, and treats. You can additionally make new close friends by participating in team tasks like classes, leisure activity groups, or volunteering.

Seeking a new hobby that includes conference with a team will certainly aid you learn more about your peers and add a recurring to-do to your weekly timetable. Discussions during these experiences can concentrate on present events, household, previous fields of job, enjoyment, or traveling, which all offer simple subjects for small talk.

When you visit an area, make sure to request its existing regular monthly calendar. This will reveal the sorts of events and solutions offered to homeowners, which may aid you select your following home. Our Family Advisors can aid you construct a listing of communities that meet your demands by offering a comparison of costs, functions and amenities, consumer reviews, and a lot more.

Whether you are searching for the ideal neighborhood for your aging liked ones, or making a move to elderly living yourself, there are lots of considerations to make. It is essential to differentiate your needs from your wants and figure out if the retirement community can satisfy those needs.

For instance, think about the safety and security attributes and features that a community uses. Some retirement communities have front entrances that are shielded by gates or 24-hour security electronic cameras. Others might give citizens with personal emergency response systems that link directly to the community's clinical staff.

It's additionally essential to discover a retirement community that is transparent concerning their everyday practices and treatment. You can do this by asking to see their Facility for Medicare and Medicaid Services score, along with reviewing on the internet testimonials and ratings from the lasting care ombudsman in your state.

Choosing a retirement home that enables you to follow your passions is very important. If you want horticulture, cooking, music, art, or motion picture evenings, a community that does not supply these opportunities can really feel disjointed and separated.

Observe just how homeowners and employee communicate when you see an area. This can tell you a great deal concerning the setting.

Location

The place of your retirement community will influence just how you experience life and play. You may favor to hug friends and family, yet you might also intend to transfer to a much more temperate climate or a place with a various culture.

When you check out a prospective retirement community, drive around and see just how easy it is to get from one part of the residential property to one more. You ought to additionally take note of safety and security measures and safety functions. Ask about visiting hours and whether there is a check-in area for site visitors, and make sure that the facility uses a variety of means to make medical consultations with neighborhood specialists (physiotherapists, optometrist, dental practitioners).

If you pick to purchase a home in a community, make sure to consider month-to-month homeowner organization costs, in addition to real estate taxes. These costs assist keep the grounds and typical locations, and can include pool maintenance, lawn care, utility costs, and fitness solutions.

Facilities

There are several factors to consider when choosing the appropriate retirement home. Expenses are very important to take into consideration, but it is important to also evaluate the level of services provided. Services include housekeeping, restaurant-style dining, transportation solutions, and other services like visitor dishes and concierge solution. Some communities offer these services as part of the flat monthly fee, while others may charge extra costs for medical-related services or medication management.

find more -72.57557943291285!3d42.11033545084142!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x89e6e7c483c68d3b%3A0xd8a264e7012086a5!2sLoomis%20Lakeside%20at%20Reeds%20Landing%20in%20Springfield!5e0!3m2!1sen!2sus!4v1699913940460!5m2!1sen!2sus" width="600" height="450" style="border:0;" allowfullscreen="" loading="lazy" referrerpolicy="no-referrer-when-downgrade">

Make certain to tour the area and observe just how homeowners interact with one another. If possible, demand to see an updated calendar of events and note whether the tasks match your interests. For example, if you have a passion for arts and crafts, you should discover if the retirement community uses areas devoted to artistic leisure or workshops. You ought to additionally pay very close attention to whether the community motivates sees from member of the family. If not, you might require to look in other places. If so, you might intend to pick a much more independent living community that provides a variety of features and services to match your way of life requires.

Socializing

Numerous retirement communities have a variety of socialization possibilities. Mealtimes are excellent areas to satisfy individuals and appreciate the business of others, with lots of offering restaurant-style dining choices for breakfast, lunch, dinner, and treats. You can additionally make new close friends by participating in team tasks like classes, leisure activity groups, or volunteering.

Seeking a new hobby that includes conference with a team will certainly aid you learn more about your peers and add a recurring to-do to your weekly timetable. Discussions during these experiences can concentrate on present events, household, previous fields of job, enjoyment, or traveling, which all offer simple subjects for small talk.

When you visit an area, make sure to request its existing regular monthly calendar. This will reveal the sorts of events and solutions offered to homeowners, which may aid you select your following home. Our Family Advisors can aid you construct a listing of communities that meet your demands by offering a comparison of costs, functions and amenities, consumer reviews, and a lot more.

Safety and security

Whether you are searching for the ideal neighborhood for your aging liked ones, or making a move to elderly living yourself, there are lots of considerations to make. It is essential to differentiate your needs from your wants and figure out if the retirement community can satisfy those needs.

For instance, think about the safety and security attributes and features that a community uses. Some retirement communities have front entrances that are shielded by gates or 24-hour security electronic cameras. Others might give citizens with personal emergency response systems that link directly to the community's clinical staff.

It's additionally essential to discover a retirement community that is transparent concerning their everyday practices and treatment. You can do this by asking to see their Facility for Medicare and Medicaid Services score, along with reviewing on the internet testimonials and ratings from the lasting care ombudsman in your state.

SPOILER ALERT!

Below Are The Things You Ought To Think About When Choosing An Assisted Living Area For Your Enjoyed One

Article by-Lin Banks

Initially, make sure that the assisted living neighborhood has emergency devices. You'll likewise want to find out exactly how promptly they can get locals to a medical facility if they have a clinical emergency situation. retirement home near me might be a top concern for you if your enjoyed one is in a significant condition, or if they have wellness problems that call for immediate treatment. http://fredric83doyle.tblogz.com/assisted-living-can-be-an-excellent-fit-for-seniors-who-require-assistance-26830795 need to additionally validate that is accountable for payment, and also see the facility to see what they offer.

The social benefits of independent living are typically more vital to older grownups who have actually lived alone for years. Independent living areas might consist of usual dining halls, game rooms, computer as well as library rooms. Some also supply business facilities. While helped living neighborhoods give treatment, independent living is a superb option for those who require support with day-to-day activities however still wish to keep their independence. These neighborhoods can also provide transport for you. Aided living neighborhoods can assist you keep your social life, so you can continue to do the important things you take pleasure in many.

Helped living communities are residential communities for older grownups with varying levels of health problems. They usually have a few loads to numerous hundred homeowners. They operate just like retirement communities, yet with added health care assistance. Aided living areas are not constantly clinically extensive. Nonetheless, if you need extra aid for day-to-day jobs, a competent team at an assisted living area can assist. Furthermore, they provide 1 day team to take care of any unexpected issues that might occur. Assisted living areas can assist bridge the gap in between your loved one's home treatment and at home care.

Assisted living communities supply even more options than ever. The cost of these communities can be high or reduced. While you can choose the place that is most practical, there are also various other aspects that should be taken into consideration before choosing an assisted living neighborhood. Regardless of where you choose, ensure you have a financial plan in place. In addition, you must inspect the community's transfer and discharge policies. While some assisted living facilities restrict legal action, other plans might give you the option to resolve the dispute via a various method.

Throughout the shift duration, your liked one might experience some sensations of loss. Relocating to an assisted living facility is a major upheaval and also needs to not be minimized. Provide time to adapt to their new house. Preferably, check out or call them regularly. Normal get in touch with can make a substantial difference and also assistance reassure your enjoyed one that you're there for them. It additionally makes it easier if they don't live near you.

If you're having problem changing, take into consideration speaking with the facility supervisor or a relied on pal. Assisted living facilities differ greatly from each other, so make sure to ask great deals of concerns. Besides meeting the homeowners, see them as well as speak to their family and staff. It is necessary to make on your own comfy with the brand-new living setting and the new personnel. When possible, consume a dish at one of the centers so you can communicate with them as they consume.

An additional benefit of assisted living is the reality that family members take a more active role. Relative are typically kept upgraded about their loved one's condition, as well as assigned member of the family are consisted of in the treatment preparation procedure. This is necessary, as family members interaction and assistance are vital to psychological and physical health. Because of this, the assisted living community should be welcoming to family members and also their enjoyed one. If you have concerns concerning a loved one's health, take into consideration relocating into an area where the residents have access to professional care.

Assisted living areas provide locals with trusted transportation. Locals can conveniently navigate town, attend medical professional appointments, and also shop. They are supplied with experienced experts that can help them with their everyday tasks, such as showering as well as dressing. The aid is not restricted to these fundamental needs; it can be as comprehensive as the care they need for a healthy lifestyle. You can seek your leisure activities as well as delight in gatherings while a professional team deals with your enjoyed one's everyday tasks.

When looking for an assisted living area, make certain to follow a structured process. Ask lots of questions, as well as review each center's contract before signing. Most notably, see to it to involve your loved one in the decision-making process. Choosing a nursing home is a life-altering decision and should be done in appointment with member of the family. With almost a million beds in the USA, you'll need to be positive to choose the best one for your liked one.

Initially, make sure that the assisted living neighborhood has emergency devices. You'll likewise want to find out exactly how promptly they can get locals to a medical facility if they have a clinical emergency situation. retirement home near me might be a top concern for you if your enjoyed one is in a significant condition, or if they have wellness problems that call for immediate treatment. http://fredric83doyle.tblogz.com/assisted-living-can-be-an-excellent-fit-for-seniors-who-require-assistance-26830795 need to additionally validate that is accountable for payment, and also see the facility to see what they offer.

The social benefits of independent living are typically more vital to older grownups who have actually lived alone for years. Independent living areas might consist of usual dining halls, game rooms, computer as well as library rooms. Some also supply business facilities. While helped living neighborhoods give treatment, independent living is a superb option for those who require support with day-to-day activities however still wish to keep their independence. These neighborhoods can also provide transport for you. Aided living neighborhoods can assist you keep your social life, so you can continue to do the important things you take pleasure in many.

Helped living communities are residential communities for older grownups with varying levels of health problems. They usually have a few loads to numerous hundred homeowners. They operate just like retirement communities, yet with added health care assistance. Aided living areas are not constantly clinically extensive. Nonetheless, if you need extra aid for day-to-day jobs, a competent team at an assisted living area can assist. Furthermore, they provide 1 day team to take care of any unexpected issues that might occur. Assisted living areas can assist bridge the gap in between your loved one's home treatment and at home care.